Table of Contents

Introduction

Applying for a credit card can feel like navigating a complex puzzle, with endless options, terms, and concerns about how it might affect your finances. If you’ve received a Getmyoffer Capital One invitation, whether through the mail or in your email inbox, you’re already on a simpler path to finding the right credit card. This guide breaks down the Getmyoffer Capital One Application in clear, straightforward language, so you know exactly what to expect. We’ll cover what Getmyoffer is, the benefits it offers, and who can take advantage of this program, setting you up to make informed decisions without any confusion.

What Is Getmyoffer Capital One?

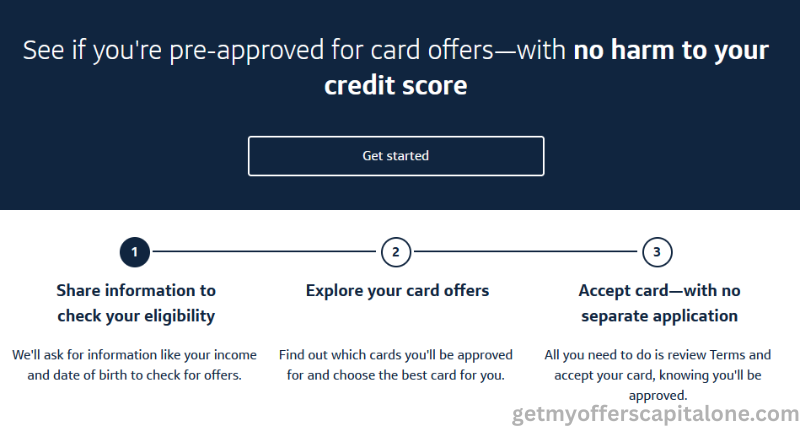

Getmyoffer Capital One is an online platform that makes applying for a credit card simpler and more tailored to your financial situation. When you receive an invitation, it means Capital One has already reviewed your credit profile using a soft inquiry—a quick check that doesn’t affect your credit score. This allows them to match you with credit card offers that best fit your needs and lifestyle.

Depending on your spending habits, you might see options for cashback on everyday purchases, travel rewards for frequent flyers, or cards designed to help build credit. Unlike a typical credit card application—where approval is uncertain—Getmyoffer shows you pre-approved offers you’re more likely to qualify for. It’s a faster, more confident way to find the right Capital One credit card without the guesswork.

Key Advantages of Getmyoffer Capital One?

The Getmyoffer Capital One Application process is designed to make things easier and give you clear advantages over the usual credit card application route. Here’s what makes it stand out:

- Personalized Card Offers: Capital One reviews your credit information to suggest cards that match your lifestyle and spending habits. For instance, if you tend to spend more on dining or groceries, you might see offers for cards like SavorOne, which gives higher cashback in those areas. Prefer to avoid annual fees? Options like Quicksilver help you keep things simple and affordable.

- No Impact on Your Credit Score: The pre-approval step uses a soft inquiry, meaning it checks your credit without lowering your score. You can safely explore and compare offers without worrying about any negative impact before moving forward with a full application.

- Better Approval Odds: Since Capital One pre-screens you before sending an offer, your chances of getting approved are usually higher than with a standard application. While approval isn’t guaranteed, it’s a strong sign that you already meet the card’s basic requirements, helping you avoid unnecessary rejections.

Overall, Getmyoffer provides a convenient and confidence-boosting way to find a Capital One card that fits your needs—whether you’re focused on earning rewards or building credit responsibly.

1. Understanding the Getmyoffer Capital One Invitation

If you’ve received a Getmyoffer Capital One invitation, you’re ready to unlock credit card offers designed specifically for you. This section walks you through how to understand your invitation, whether it arrives by mail or email. We’ll cover how Capital One selects people for these offers, the key details you need to spot in your invitation, and what steps to take if you haven’t received one. Our goal is to make this process straightforward, so you can confidently move forward with your application.

How Capital One Picks People for Getmyoffer

The Capital One Getmyoffer program is open to U.S. residents aged 18 and older with credit profiles ranging from fair to excellent.

Capital One carefully chooses who receives a Getmyoffer invitation to ensure the offers match your financial needs. They start with a soft credit check, which is a quick review of your credit history that doesn’t affect your credit score. This check looks at factors like your payment history—whether you consistently pay bills on time—and your credit utilization, which is how much of your available credit you’re using. For example, if you keep your credit card balances low and pay on time, you’re more likely to get an invitation. Capital One uses this information to tailor offers to your lifestyle, such as:

- Cards with cashback rewards for everyday purchases like groceries or gas.

- Travel-focused cards with miles for flights or hotel stays.

- Starter cards for building credit with lower limits and simpler terms.

This pre-screening process means the cards you’re offered are ones you’re more likely to be approved for, saving you from the uncertainty of a standard application. It’s a thoughtful approach that helps you find a card that fits your financial habits without unnecessary risk.

Decoding Your Invitation

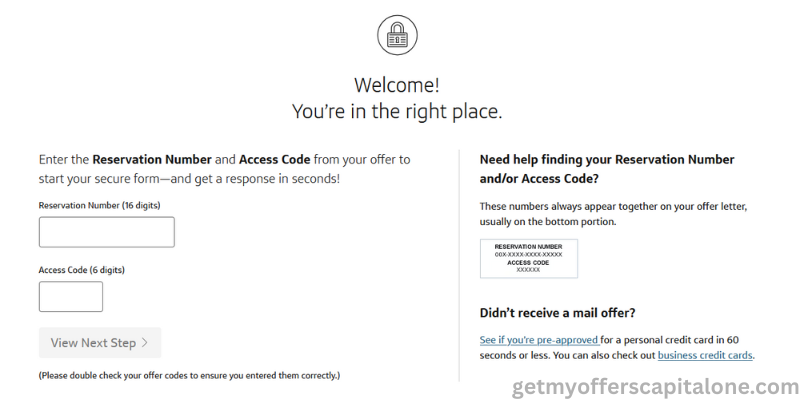

Your Getmyoffer invitation, whether it’s a letter or an email, contains important details you’ll need to access your personalized credit card offers. The most critical pieces are the Getmyoffer Capital One 16-digit reservation number and the 12-digit access code. These numbers are unique to you and act like a secure key to unlock your offers on the Getmyoffer website.

Make sure to keep these numbers safe and enter them exactly as shown when you visit the website. The invitation might also include a brief description of the cards or benefits, such as low interest rates or bonus rewards for new cardholders. Take a few minutes to read through it carefully, as it helps you understand what to expect when you log in to view your offers.

What If You Haven’t Received an Invitation?

If you haven’t gotten a Getmyoffer invitation, you can still explore credit card offers through Capital One’s online tools. Visit capitalone.com and look for the pre-qualification section, often found under “Credit Cards” or “Check for Pre-Approved Offers.” This tool asks for basic information, such as your name, address, income, and Social Security number, to perform a soft credit check, just like the one used for mailed invitations. The process is simple, secure, and won’t harm your credit score. Here’s how it works:

- Enter Your Details: Fill out the online form with accurate information to help Capital One assess your eligibility.

- Review Offers: If you qualify, you’ll see a list of cards with details like rewards, fees, and interest rates.

- Next Steps: If no offers appear, Capital One may suggest ways to improve your chances, like paying down debt or checking again later.

This online pre-qualification tool is a great alternative, giving you the same opportunity to find personalized card offers without waiting for an invitation. It’s quick, typically taking just a few minutes, and keeps your credit score safe while you explore your options.

2. Step-by-Step Application Walk-through

Now that you’ve received your Getmyoffer Capital One invitation, to apply for the card — the online Getmyoffer Capital One Application process is quick and simple. Let’s walk through it step by step to keep things simple and clear.

How Do I Start?

To begin, visit the Getmyoffer website at getmyoffer.capitalone.com. This is the official portal where you’ll access your personalized credit card offers. Once you’re on the site, you’ll need to enter two important numbers from your invitation:

- 16-Digit Reservation Number: This number links directly to the offers Capital One has selected for you based on your credit profile.

- 12-Digit Access Code: This code verifies your identity to ensure only you can view your offers.

Type these numbers exactly as they appear in your mailed letter or email. After submitting them, you’ll see a list of credit card offers tailored to your needs, such as cards for cashback, travel rewards, or building credit. Each offer will include details like annual fees, interest rates, and reward structures, so you can compare them and pick the one that fits your lifestyle best. This step usually takes just a minute or two, and it’s first step of the application process.

What Information Do I Need to Apply?

Once you’ve selected a card from your offers, the Getmyoffer Capital One Application process itself is quick, typically taking 5 to 10 minutes. You’ll need to provide some basic information to complete the form. Here’s what Capital One will ask for:

- Personal Details: Your full name, date of birth, and contact information, like your phone number and email address.

- Address: Your current home address, including city, state, and ZIP code, to verify your location.

- Social Security Number (SSN): This is used to check your credit history during the Getmyoffer Capital One Application process.

- Income Information: Your annual income or monthly earnings, which helps Capital One determine your credit limit and eligibility.

You can fill out the form directly on the website, and it’s designed to be simple, with clear prompts guiding you through each step. Have your information ready before you start to make it even faster. Once you submit, Capital One will review your application, and you could get a decision in as little as few minutes, though some cases may take longer.

Filling Out the Form: Tips for Accuracy to Avoid Delays

When applying for a credit card through Getmyoffer Capital One, filling out the application form correctly is key to keeping the process smooth and quick. Mistakes or missing information can slow things down or even lead to a rejection. This section provides simple, practical tips to help you complete the form accurately, ensuring your application moves forward without delays.

- Double-Check Your Personal Information: Enter your full legal name, date of birth, and contact details exactly as they appear on official documents like your driver’s license or Social Security card. For example, if your name includes a middle initial or suffix (like Jr.), include it. Typos in your phone number or email can cause issues if Capital One needs to reach you. Take a moment to review each field before moving on.

- Verify Your Address: Use your current, permanent address, including apartment numbers if applicable. Make sure the city, state, and ZIP code are correct, as Capital One uses this to confirm your identity and location. If you’ve recently moved, avoid using an old address, as mismatched information can flag your application for further review, delaying the process.

- Enter Your Social Security Number Carefully: Your SSN is critical for the credit check, so type it slowly and check for errors. A single wrong digit can cause confusion or lead to a rejected application. If you’re unsure, have your Social Security card nearby to confirm the number. This step is especially important since it ties directly to your credit history.

- Be Accurate with Income Details: Provide your total annual or monthly income, including wages, self-employment earnings, or other sources like alimony or investments. Don’t inflate or guess your income, as Capital One may verify it. If you’re unsure, check recent pay stubs or tax documents to get the exact figure. Accurate income helps determine your credit limit and eligibility.

- Review Before Submitting: Before hitting the submit button, go through each section of the form to ensure everything is correct and complete. Missing fields, like an incomplete address or skipped income question, can pause your application while Capital One requests more information. A quick review can save days of waiting.

- Save Your Confirmation Number: After submitting, you’ll get a confirmation number or email. Write it down or save the email, as you’ll need it to check your application status if there’s a delay. This number helps Capital One track your application quickly if you need to call their support line at 1-800-227-4825.

By following these tips, you can fill out the Getmyoffer application form with confidence, reducing the chance of errors that could slow down your approval.

3. Post-Application: Approval and Next Steps

After submitting your Getmyoffer Capital One application, you’re probably eager to know what happens next. This section explains what to expect once you’ve applied, whether you’re approved right away, still waiting for a decision, or not approved. We’ll cover how your credit limit is set, when you can expect your card, what to do if your application is pending or denied, and how to activate your card. Let’s break it down to keep things clear and simple.

If Approved: Credit Limit and Card Delivery

If your Getmyoffer Capital One Application is approved, congratulations—you’re on your way to getting your new Capital One credit card! Here’s what happens next:

- Credit Limit Assignment: Capital One will assign you a credit limit based on your income, credit history, and the card you chose. For example, a card like the Quicksilver might come with a limit ranging from $500 to $10,000, depending on your financial profile. You’ll see your limit in the approval notice, which may arrive instantly online or within a few days by email or mail. If you’re hoping for a higher limit, you can contact Capital One later to discuss options, especially after using the card responsibly for a few months.

- Card Delivery Timeline: Once approved, your physical card will be mailed to the address you provided. It typically arrives in 7 to 10 business days, though it may take slightly longer during busy periods like holidays. You’ll get a tracking number in some cases, which you can check through your Capital One account or by calling customer service at 1-800-227-4825. Keep an eye on your mailbox, and make sure someone is available to receive the card, as it may require a signature for security. In the meantime, you can start exploring the card’s features, like rewards or mobile app tools, through Capital One’s website.

This step is exciting because it means you’re close to using your new card, whether for earning cashback, travel points, or building your credit.

If Pending or Denied: Checking Status and Understanding Reasons

Not all applications get an instant approval, and that’s okay. If your Getmyoffer Capital One Application is pending or denied, Capital One provides ways to understand and address the outcome. Here’s how to handle it:

- Pending Applications: If your application is marked as pending, it means Capital One needs more time to review your information. This could happen if they need to verify details like your income or address. You can check your application status online at the Capital One Application Center by logging into your account or using the confirmation number you received after applying. Alternatively, call 1-800-227-4825 to speak with a representative who can provide an update. Pending decisions often resolve within a few days, so check back regularly.

- Denied Applications: If your application is denied, Capital One will send a letter or email explaining why. Common reasons include incomplete information (like a missing SSN or incorrect address), a low credit score, or high credit utilization. Review the explanation carefully to understand what went wrong. You can also call 1-800-227-4825 to discuss the denial and ask if there’s a chance to reconsider, especially if you can correct an error, like updating your income. If denied, you may need to wait 30 days before reapplying, or work on improving your credit, such as paying down existing balances.

- Tips for Next Steps: Whether pending or denied, keep your confirmation number handy for tracking. If you’re waiting, avoid applying for other cards in the meantime, as multiple applications can affect your credit. If denied, use Capital One’s free CreditWise tool to monitor your credit and get tips on improving it for future applications.

Understanding the status and reasons helps you stay proactive and prepared for your next move.

Activating Your Card and Setting Up Your Account

Once your card arrives, you’ll need to activate it and set up your online account to start using it. This process is quick and gives you access to manage your card effectively. Here’s how to do it:

- Activating Your Card: You can activate your card in three ways:

- Through the Capital One Mobile App: Download the app from the App Store or Google Play, log in with your Capital One account (or create one), and follow the prompts to activate your card. This is the fastest option, often taking less than a minute.

- On the Website: Visit capitalone.com, sign in, and find the activation option under your account dashboard. Enter the card details, like the card number and security code, to activate it.

- By Phone: Call the number on the sticker attached to your new card (usually 1-800-678-7820) and follow the automated instructions. You’ll need your card number and some personal details to verify your identity.

- Setting Up Your Online Account: If you don’t already have a Capital One account, create one at capitalone.com or through the mobile app. You’ll need your card number, SSN, and email address. Once set up, you can:

- Check your balance and transactions in real time.

- Set up auto-pay to avoid missing payments.

- Redeem rewards if your card offers them, like cashback or travel miles.

- Enable alerts for purchases or due dates to stay on top of your account.

Activation takes just a few minutes, and setting up your online account helps you manage your card easily, whether you’re tracking spending or paying your bill. With these steps done, you’re ready to start using your new card confidently.

4. Maximizing Your New Card

Once your new Capital One card is activated, it’s time to make the most of it. This section covers how to take advantage of welcome bonuses and ongoing rewards, avoid common mistakes that could hurt your credit, and use tools like the Capital One app to stay on top of your account. Let’s dive into simple, practical ways to get the best out of your new card.

Welcome Bonuses and Ongoing Rewards Strategies

Your Capital One card likely comes with perks like welcome bonuses or rewards for everyday spending. Here’s how to make the most of them:

- Welcome Bonuses: Many Capital One cards offer a one-time bonus for new cardholders. For example, the Venture Rewards card might give you 75,000 miles if you spend $4,000 within the first three months, while the Quicksilver card could offer $200 cashback after spending $500 in the same period. To earn these:

- Check the bonus terms in your approval letter or online account to know the spending goal and deadline.

- Plan your purchases, like groceries or bills, to meet the requirement without overspending.

- Track your progress in the Capital One app to ensure you hit the target on time.

- Avoid returns on purchases used for the bonus, as they might reduce your eligible spending.

- Ongoing Rewards: Depending on your card, you can earn rewards on every purchase. For instance, the SavorOne card gives 3% cashback on dining and entertainment, while the Platinum card focuses on building credit without rewards. To maximize rewards:

- Use your card for categories with the highest rewards, like dining or travel, if applicable.

- Pay your balance in full each month to avoid interest charges that could cancel out your rewards.

- Redeem rewards regularly through the Capital One app or website, whether for cash, gift cards, or travel credits.

- Check for limited-time offers, like extra cashback at certain stores, in your account dashboard.

- Stay Organized: Set a calendar reminder for the bonus deadline, and review your card’s reward structure to know which purchases earn the most. This helps you plan spending to get the biggest return, whether it’s cashback, miles, or other perks.

By focusing on these strategies, you can unlock the full value of your card’s bonuses and rewards, making every purchase work harder for you.

Common Pitfalls: Avoiding High Utilization Post-Approval

Using your new card responsibly is key to keeping your credit healthy. One common mistake to avoid is high credit utilization, which is the percentage of your credit limit you’re using. For more practical tips, check out our guide on Mastering Credit Building: 10 Proven Strategies to Build Your Credit Score. Here’s how to steer clear of this and other pitfalls:

- Keep Utilization Low: Try to use less than 30% of your credit limit at any time. For example, if your limit is $1,000, keep your balance below $300. High utilization can lower your credit score, even if you pay on time. To manage this:

- Make small, frequent payments throughout the month to keep your balance low.

- Avoid big purchases that push you close to your limit, especially right after approval.

- Check your balance regularly in the Capital One app to stay within a safe range.

- Pay on Time: Missing a payment or paying late can hurt your credit and lead to fees. Set up autopay through your online account to ensure you never miss a due date.

- Don’t Overspend for Rewards: It’s tempting to spend more to earn a welcome bonus or rewards, but only spend what you can pay off in full. Carrying a balance means paying interest, which can outweigh any rewards you earn.

- Watch for Fees: Some cards have annual fees or foreign transaction fees. Read your card’s terms to know what fees apply and avoid surprises. For example, the Platinum card has no annual fee, but premium cards like Venture might.

Keeping your utilization low and payments on time helps you build a strong credit history while enjoying your card’s benefits without stress.

Long-Term Tips: Monitoring with the Capital One App

To get the most out of your card over time, use the Capital One app to manage your account and protect it from fraud. Here’s how to stay on top of things:

- Download the App: Get the Capital One Mobile app from the App Store or Google Play. It’s free and lets you check your balance, view transactions, and pay your bill from anywhere.

- Set Up Fraud Alerts: Turn on notifications in the app for real-time alerts about purchases, payments, or suspicious activity. This helps you catch unauthorized charges quickly. For example, you’ll get a notification if your card is used for an unusual purchase, like one in a different state.

- Monitor Your Spending: The app shows your recent transactions and available credit, so you can track your utilization and avoid going over 30%. It also breaks down spending by category, like dining or gas, to help you see where your money goes.

- Use CreditWise for Free: Capital One’s CreditWise tool, available in the app, lets you monitor your credit score and get tips to improve it. It’s free, even for non-cardholders, and updates weekly to show how your card use affects your credit.

- Check for Upgrades: Over time, responsible use might qualify you for a higher credit limit or a better card with more rewards. Use the app to check for upgrade offers or contact Capital One at 1-800-227-4825 to ask about options.

By using the app regularly, you can stay informed, protect your account, and make smart choices to keep your card working for you in the long run.

Conclusion

The Getmyoffer Capital One application process makes applying for a credit card simple, clear, and tailored to your needs. From receiving your invitation to activating your new card, each step is designed to help you find the right card without stress or surprises. This section wraps up the key points of the process and encourages you to take the first step toward smarter credit today.

If you’re interested in checking your credit card options, visit getmyoffer.capitalone.com and enter your reservation and access codes to view your personalized offers. It only takes a few minutes to see what Capital One has selected for you and decide which option fits your needs best.