Table of Contents

If you’ve received a letter or email from Capital One with a reservation code and access code for their GetMyOffer program, you might be curious about what it means and how it can help you.

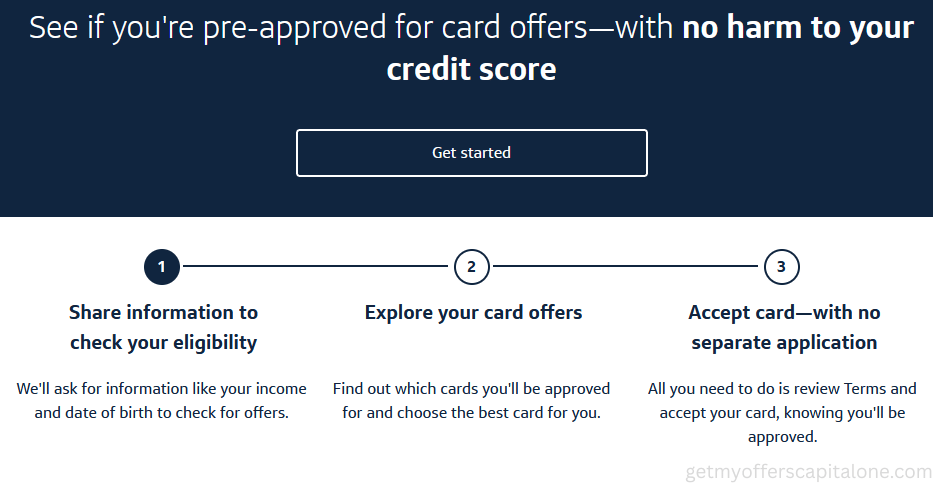

The Capital One GetMyOffer program is designed for the company to connect with folks who might qualify for one of their credit cards. They send you a unique reservation and access codes, typically through the mail or email, which allows you to check out pre-approved card offers without any impact on your credit score. It’s like getting a personal invitation to explore credit cards that fit your financial needs, whether you’re after rewards, cash back, or looking to build your credit.

In this article, I’ll guide you through everything you need to know about the GetMyOffer Capital One reservation code—what it is, how to use it, how to get and what to expect along the way. Let’s dive in to understand more.

What is the GetMyOffer Reservation Code?

The GetMyOffer Capital One reservation code is a special mix of numbers and letters that Capital One sends out to select individuals via mail or email. Think of it as your personal invitation to check out pre-approved credit card offers that are tailored just for you based on your financial profile. When you get this code, it means Capital One has taken a look at some basic details about your credit history and thinks you might qualify for one or more of their credit cards, whether that’s cash back, travel rewards, or options to help you build your credit.

Using the reservation code is pretty straightforward. You’ll need it along with an access code that comes in the same letter or email to log into Capital One’s GetMyOffer website. Once you enter these codes, you can see the specific credit card offers that are available to you. The best part? This process is designed to keep your credit score safe—checking your offers with the reservation code only involves a “soft” credit inquiry, which won’t affect your score. This is different from a full credit card application, which might lead to a “hard” inquiry that could impact your score.

The reservation code is important because it makes finding a credit card that fits your needs much easier. Instead of sifting through countless cards and credit card companies or applying without knowing, the code links you to offers that Capital One has matched to your credit profile. This targeted approach saves you time and helps you avoid applying for cards you might not qualify for. For instance, someone with a solid credit history might see offers for rewards cards, while someone working on their credit could be shown secured card options. By using the reservation code, you get a clearer view of what’s out there, making it simpler to pick a card that aligns with your financial goals.

Who can get the GetMyOffer Capital One Reservation Code?

Eligibility for the Reservation Code

The GetMyOffer Capital One reservation code is sent to individuals who Capital One identifies as potential candidates for their credit cards. Eligibility is not guaranteed for everyone, as it depends on Capital One’s internal criteria. Generally, you may receive a reservation code if you have a credit profile that aligns with one of their card offerings, which range from rewards cards for those with strong credit to secured cards for those building credit. You don’t need to be an existing Capital One customer to qualify, but you must be at least 18 years old and a U.S. resident, as these are standard requirements for most credit card offers.

How Capital One Selects Recipients?

Capital One uses a pre-approval process to determine who receives a GetMyOffer Capital One reservation code. This process involves a soft credit inquiry, which allows them to review basic information about your credit history without affecting your credit score. They pull data from credit bureaus, such as your payment history or credit utilization, to assess whether you’re a good fit for their cards. If you match their criteria, Capital One sends you a reservation code via mail or email. These offers are often targeted, so you might receive one unexpectedly if your credit profile aligns with their current marketing campaigns.

Factors That Influence Pre-Approval

Several factors influence whether you receive a reservation code. Your credit score is a key consideration, as Capital One offers cards for a wide range of credit levels—from excellent to limited credit history. Other factors include your income, debt-to-income ratio, and recent credit activity, which help Capital One gauge your ability to manage a credit card. For example, consistent on-time payments or low credit card balances might increase your chances of receiving an offer. Additionally, if you’ve opted into receiving marketing communications from Capital One or have interacted with their services, you may be more likely to be selected for a reservation code.

How to Increase Your Chance to Pre-Qualify?

While Capital One’s pre-approval process is based on their internal criteria, there are steps you can take to improve your chances of receiving a GetMyOffer Capital One reservation code.

- Maintain a healthy credit profile by paying bills on time consistently.

- Keep credit card balances low to show responsible credit use.

- Check your credit report for errors and dispute inaccuracies to ensure accurate data.

- Opt into Capital One’s marketing communications, like emails or mail offers, to be included in outreach campaigns.

- Use Capital One’s online pre-qualification tool to check for potential offers without impacting your credit score.

Step-by-Step Process to Use the Reservation Code

Using your GetMyOffer Capital One reservation code is a straightforward process that helps you explore and apply for a Capital One credit card tailored to your needs. Below is a clear guide to walk you through each step, from accessing the website to understanding what happens after you apply.

- Visit the official GetMyOffer page: Head over to Capital One’s official GetMyOffer website. It’s crucial to use this specific link to keep your information safe. Make sure not to enter your reservation code on any other site, as only the official page is equipped to handle these offers securely. You can access the site from either a computer or a mobile device, but it’s best to do so over a secure internet connection.

- Enter the reservation code and access code: Once you’re on the GetMyOffer page, you’ll find fields where you can enter your reservation code and access code. These codes are included in the letter or email you received from Capital One. The reservation code is usually a 16-digit number, while the access code is a 6-digit number. Be sure to enter them carefully, as mistakes can stop you from accessing your offers. If you run into any issues, double-check the codes or reach out to Capital One’s support for assistance.

- Review available card offers and terms: After you’ve entered your codes, the website will show you the credit card offers that are available to you. These might include options for cash back, travel rewards, or building credit, depending on your pre-approved profile. Take your time to read through the details, such as the annual percentage rate (APR), annual fees, and any rewards programs. For instance, some cards may offer 1.5% cash back on purchases, while others might not have an annual fee. Compare the terms to find the card that best matches your financial goals, whether that’s paying off purchases over time or earning rewards.

- Complete the secure application process: To complete the secure application process, start by selecting a card that suits your needs. After that, you’ll need to fill out the application with some personal details like your name, address, and income information. Don’t worry—this step is secure and usually takes about 60 seconds for Capital One to process. Just a heads up, the application might involve a hard credit inquiry, which could have a minor impact on your credit score. But the good news is that you’ll typically get a quick response to let you know if you’re approved.

- Post-application steps: If approved, you can expect your new Capital One credit card to arrive in the mail within 7–10 business days. You’ll need to activate the card before using it, which can usually be done online or by calling the number provided with the card. Capital One may also send you information about tools like their mobile app or CreditWise to help you manage your account and monitor your credit. If your application isn’t approved, you’ll receive an explanation, and you can contact Capital One at 1-800-903-9177 to check your application status or explore other options.

Alternate Methods to Check Pre-Qualified Cards

If you haven’t received a GetMyOffer reservation code, there are other ways to explore Capital One credit card offers based on your credit profile.

- Capital One Pre-Qualification Tool: Use Capital One’s online pre-qualification tool to check offers without a reservation code. Enter basic personal information, like name and Social Security Number, for a soft inquiry that doesn’t affect your credit score.

- Visit your Capital One Local Branch: Visit a Capital One branch or Café to discuss potential offers with a representative; find Capital One Branch Locations.

- Email, Newsletters & Mailbox: Check your email for Capital One promotions or sign up for marketing communications on their website to receive future pre-qualification offers.

FAQ – GetMyOffer Capital One Reservation Code

1. Does using the Getmyoffer Capital One reservation code affect my credit score?

Not at all! When you use your reservation code to check out offers on the GetMyOffer website, it only involves a soft credit inquiry, which won’t affect your credit score. However, if you decide to go ahead with a full application, a hard inquiry might be done, which could have a slight impact on your score.

2. What should I do if my reservation code doesn’t work?

If your code isn’t working, make sure you’ve entered the 16-digit reservation code and the 6-digit access code correctly—typos happen! Also, ensure you’re on the official GetMyOffer website. If you’re still having trouble, reach out to Capital One’s Applications team at 1-800-903-9177 (Monday–Friday, 8 a.m.–8 p.m. ET) or chat with the Eno chatbot on their website for help. If your code has expired or there are technical issues, they’ll be able to assist you.

3. Can I use the GetMyOffer Capital One reservation code if I’m already a Capital One customer?

Absolutely! Current Capital One customers can use a reservation code to check out more card offers. The code is linked to your credit profile, not your existing account status, so you might qualify for different cards, including those with rewards or higher credit limits.

4. What types of cards can I get with the reservation code?

Looking to find out what types of cards you can snag with your reservation code? Well, it all comes down to your credit profile. You might come across options like cash back cards (think Quicksilver), travel rewards cards (like Venture), or even cards designed to help you build credit (such as the Platinum Secured). Each offer will lay out the details, including APR, fees, and rewards, so make sure to take a good look at them to find the one that suits you best.

5. How long is the reservation code valid?

Typically, these codes come with an expiration date, which you can usually find in the offer letter or email. If there’s no date mentioned, it’s a good idea to use the code sooner rather than later, as offers can vanish in just a few weeks or months. If you’re ever in doubt about your code’s validity, don’t hesitate to reach out to Capital One at 1-800-903-9177.

6. Is the GetMyOffer program the same as Capital One’s pre-qualification tool?

They’re quite similar, but not exactly the same. The GetMyOffer program uses a reservation code to provide you with targeted, pre-approved offers. On the other hand, the pre-qualification tool is available online for anyone to check for potential offers without needing a code. Both methods involve soft inquiries, but GetMyOffer offers a more personalized experience.

Conclusion

Thanks for reading this guide! I hope it clarified how to use your Getmyoffer Capital One reservation code and gave you the confidence to take the next step. If you have more questions, Capital One’s support team is there to help.